Other participants īecause of the complicated legal exchange, or conveyance, of the property, one or both of the main participants are likely to require legal representation. Typically the borrowers will be the individual homeowners, landlords, or businesses who are purchasing their property by way of a loan. If the borrower fails to meet these conditions, the mortgagee may foreclose to recover the outstanding loan. Generally, the borrower must meet the conditions of the underlying loan or other obligation in order to redeem the mortgage. The borrower has the right to have the mortgage discharged from the title once the debt is paid.Ī mortgagor is the borrower in a mortgage-he or she owes the obligation secured by the mortgage. So that a buyer cannot unwittingly buy property subject to a mortgage, mortgages are registered or recorded against the title with a government office, as a public record. The mortgage runs with the land, so even if the borrower transfers the property to someone else, the mortgagee still has the right to sell it if the borrower fails to pay off the loan. As the mortgagee, the lender has the right to sell the property to pay off the loan if the borrower fails to pay. Typically, the purpose of the loan is for the borrower to purchase that same real estate. When they sell the mortgage, they earn revenue called Service Release Premium. In today's world, most lenders sell the loans they write on the secondary mortgage market. The borrower, known as the mortgagor, gives the mortgage to the lender, known as the mortgagee.Ī mortgage lender is an investor that lends money secured by a mortgage on real estate. However, in general, a mortgage of property involves the following parties. Legal systems in different countries, while having some concepts in common, employ different terminology. See mortgage loan for residential mortgage lending, and commercial mortgage for lending against commercial property.

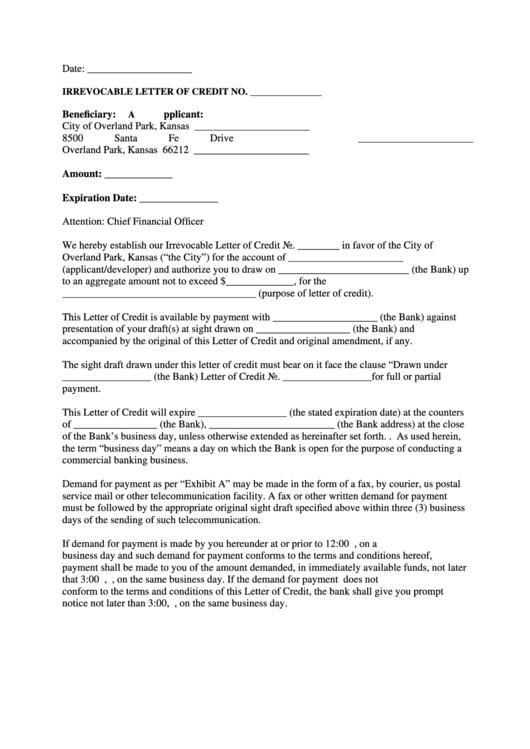

#Letter of credit applicant vs accountee full#

A mortgage is the standard method by which individuals and businesses can purchase real estate without the need to pay the full value immediately from their own resources. In most jurisdictions mortgages are strongly associated with loans secured on real estate rather than on other property (such as ships) and in some jurisdictions only land may be mortgaged. The word is a Law French term meaning "dead pledge," originally only referring to the Welsh mortgage ( see below), but in the later Middle Ages was applied to all gages and reinterpreted by folk etymology to mean that the pledge ends (dies) either when the obligation is fulfilled or the property is taken through foreclosure. In other words, the mortgage is a security for the loan that the lender makes to the borrower. It is a transfer of an interest in land (or the equivalent) from the owner to the mortgage lender, on the condition that this interest will be returned to the owner when the terms of the mortgage have been satisfied or performed. Hypothec is the corresponding term in civil law jurisdictions, albeit with a wider sense, as it also covers non-possessory lien.Ī mortgage in itself is not a debt, it is the lender's security for a debt.

Property lawĪ mortgage is a legal instrument of the common law which is used to create a security interest in real property held by a lender as a security for a debt, usually a mortgage loan. For loans secured by mortgages, such as residential housing loans, and lending practices or requirements, see Mortgage loan. This article is about the legal mechanisms used to secure the performance of obligations, including the payment of debts, with property.

0 kommentar(er)

0 kommentar(er)